We’ve all been there—you’re in the courtroom, palms are sweaty, knees weak, arms are heavy (no mom’s spaghetti, fortunately). Any minute now, the clerk will call your case, and your client will ascend the witness stand. Despite your hours of prep, you dread that your client is about to crumble under cross-examination. The hope of that big judgment you had in mind just went up in smoke.

But imagine transforming that knot of uncertainty into a tangible metric—a number you can actually work with to forecast outcomes. You can measure your client’s credibility and the projected impact of their testimony on settlements, judge’s rulings, and jury decisions. No more guesswork, no more flying blind—just hard, actionable data. The concept is refreshingly simple: Rate your client’s performance on a scale of one to five. If they’re terrible, slap a ‘one’ on them. If they’re passable, give them a ‘three.’ And if they knock it out of the park, they’re a solid ‘five.’ Twos and fours fall neatly in between.

Client Credibility Matters 💼

In the courtroom, your client’s credibility isn’t just a sidebar—it’s center stage. Every eye in the room—be it the jurors, the judge, or even the opposition—assesses your client through a lens of credibility when making their judgments. You have your own gut feelings about this, formed through the crucible of written discoveries, hours-long depositions, and candid interviews. What’s incredible, though, is that this instinctual ‘read’ you have on your client isn’t just an abstract concept—it’s quantifiable. Yes, you read that right: the credibility of your client, which can make or break your case, can be measured.

More credible clients often tip the scales toward more favorable outcomes—from case disposition to the size of settlement amounts. So, how do you transform something as abstract as credibility into hard data? The answer is delightfully straightforward. DATA.

Turning to Data 📈

By using data analytics, we can objectively measure the impact of client credibility on case outcomes and settlements. And, to no one’s surprise, the more credible your client the more valuable their case is likely to be.

The One-to-Five Scale 🌟

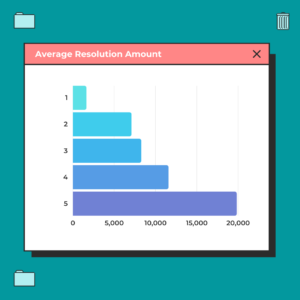

US Legal Data uses a one-to-five scale to rate client credibility after they’ve testified, with one star being the worst and five stars being the best. We then track how this rating correlates with various metrics like resolution amounts, case dispositions, and more. Here’s a snapshot of our data:

By Client Rating

- Resolution Amount: Clients with a rating of 5 have an average resolution amount of $19,825, while those with a rating of 1 have an average of just $1,629.

- Case Disposition: Clients rated 5 have won 85 out of 95 cases, while those rated 1 have only won 40 out of 140

Impeachable Convictions 🕵️♂️

- Clients without prior impeachable convictions have more favorable outcomes (meaning a case that either settled or won) at 78% compared to those with at least one at 61%.

- The average case value for clients with no impeachable convictions is $13,692 while it falls to $9,676 for clients with at least one prior impeachable conviction.

Claims History 📑

- Clients with zero prior claims have a mean resolution amount of $12,671, but as the number of prior claims increases, this amount varies significantly.

- The average resolution amount for clients with 0, 1, or 2 prior claims is $12,962, while the average resolution amount for clients with more than 3 prior claims is only $5,559.

Subsequent Claims 🔄

- Clients with zero subsequent claims have a higher chance of a favorable outcome at 83%, compared to those with one or more 74% or less.

- Clients with one or zero subsequent claims have cases that resolve for an average amount of $13,385, which drops to $7,927 for clients with two claims or more.

Real-World Applications 🌏

Data isn’t just numbers on a spreadsheet; it’s a powerful tool that can substantially influence your practice and your clients’ outcomes. Here’s how it can come into play:

Informed Decision-Making 🎯

Instead of going by gut feelings, you can present data-backed insights to your clients to help them make well-informed decisions. For instance, after analyzing your client’s deposition performance, you can offer explicit advice, saying:

👉 “Based on how you performed in your deposition, our data suggests that you’ll likely fall into the two-star client category during trial testimony. Given that, you might want to consider taking a settlement, as clients with similar credibility ratings often achieve better results through negotiations.”

This brings a level of scientific rigour to advice that would otherwise be based on subjective judgment.

Case Valuation 💰

When you understand the impact of your client’s credibility on the case’s likely outcome, you can more accurately assess its value. If your client makes a great witness, you can use this data-driven insight to negotiate for a higher settlement. For example:

👉 “Based on your strong deposition, we believe you will be an excellent witness. Our data shows that clients with your likely credibility rating see case values that are about 20% higher than average. We should aim for a settlement that reflects this.”

Strategy Formulation 🗂️

Knowing the potential outcomes also helps you formulate a more robust case strategy. Whether to push for an early settlement, invest more in evidence gathering, or go to trial can be decisions informed by data. This allows for more efficient allocation of resources—both time and money.

Mitigating Emotional Bias 🛡️

It’s natural for clients to have emotional investment in their cases. They might overestimate their own credibility or the case’s value based on their feelings rather than the facts. Using data helps counterbalance emotional bias and leads to more rational decision-making. Women lie, men lie, but numbers don’t lie, and sometimes it’s crucial for the numbers to “get in the way” of feelings to guide your clients towards the best possible outcomes.

Why You Should Start Measuring Now 🛠️

The legal industry may have been slow to adapt to the data revolution, but the wait is over. In an increasingly competitive environment, not leveraging data is tantamount to leaving money on the table—money that could be yours, going to your competitors. Here’s why you should start measuring client credibility now:

Work Smarter, Not Harder 💡

With data at your fingertips, you’re equipped to make decisions that are quicker and more accurate. No more agonizing over which way a case will go; the numbers will guide you. By reducing uncertainty, you save hours that might have been spent second-guessing your strategies—time that you can better spend serving more clients or improving your skills.

Turbocharge Your Earnings 💵

When you can quantify something as abstract as credibility, you give yourself an edge in negotiations for settlements or attorney fees. Imagine walking into a negotiation equipped with data that shows clients with similar credibility ratings as yours typically win X amount more in settlements. Your opposition will be hard-pressed to argue against hard data, setting the stage for you to maximize your client’s—and subsequently, your own—financial gain.

Client Retention & Referrals 🔄

Delivering better, more predictable outcomes for your clients doesn’t just win you that one case; it wins you a relationship. Satisfied clients are more likely to return for future legal needs and refer others to you. In this sense, your investment in data analytics pays dividends far beyond the immediate case at hand.

A Streamlined Practice 🗂️

Data allows you to spot trends, not just in case outcomes but also in how efficient your practice is. You can identify which types of cases yield better ROI, allowing you to focus your marketing and client acquisition strategies more effectively.

Risk Mitigation 🛡️

With actionable data, you can better assess which cases are likely to succeed and which aren’t worth pursuing, helping to reduce the risk associated with taking on new clients. This adds a layer of financial security to your practice by steering you clear of potential time and money sinks.

So, if you haven’t started incorporating data analytics into your practice, the time to start is now. The barriers to entry have never been lower, with numerous tools and software designed to make data analytics accessible even to those with little to no experience. The ROI isn’t just in better outcomes for your clients but in a more efficient, more profitable practice for you. Stop guessing and start measuring. Your bottom line will thank you.

Conclusion 🎯

The adage “the law is not a science” has often been used to dismiss the idea that something as fluid and complex as legal outcomes can be measured or predicted. While it’s true that every case is unique, with its own set of variables, there is increasing evidence that a data-driven approach can provide invaluable insights into legal practice. This includes making predictive assessments about client credibility, case outcomes, and even settlement values.

Our analysis points to an intriguing and, more importantly, actionable conclusion: clients who testify more credibly are significantly more likely to win their cases and secure higher resolution amounts. It’s not just a vague feeling or gut instinct; it’s backed by numbers. These aren’t minor statistical blips, either. The data suggests that more credible clients tend to win more often and secure higher settlements or judgments.

But the insights don’t stop there. Other variables, such as a client’s prior convictions and claims history, can also serve as proxy indicators for credibility. These data points, which touch on aspects of reliability, integrity, and past behavior, can be measured and integrated into a broader predictive model that can guide case strategy, settlement negotiations, and even client selection.

While intuition and experience will always play a pivotal role in the practice of law, they should be guided and informed by data. That’s the kind of modern, forward-thinking practice that adapts to the reality of the world it operates in—a world awash in data, but starved for the kind of insights that data can provide.

So, if you’re a lawyer looking to evolve and modernize your practice, it’s time to take a serious look at quantifying client credibility. By doing so, you’re not just keeping up with the times—you’re getting ahead, making your practice more efficient, and serving your clients better.

Data is transforming the way we understand law and our clients. If you’re looking to modernize your practice, the client’s most undervalued asset—their credibility—is an excellent place to start. Remember, numbers speak louder than words, and it’s time your practice started listening.

Interested in taking your legal practice to the next level with data? Let’s connect. Your future self—and your future clients—will thank you for it.